This is a question I have been asked several times. We’ve been to 7 countries and 35+ states since we’ve been married. I’ll be honest that the answer isn’t very glamorous, but it is also the answer to other questions we have received like how did you get out of grad school debt free? etc. Maybe this is a question that readers have wondered or maybe you assume that we’re wealthy; I promise, we’re not. Because my answers have been so lengthy to the question of how do you afford to travel, I’ve decided to separate the answers into two posts. This is my first post where I talk about general life tips we use to afford our to travel/ stay out of debt/ etc. My second installment of this post is how we keep travel cheap.

RELATED // the simple way we book international round trip flights for under $400 a ticket

We started financial planning early

To start out, let’s get a little personal here. We have one car loan and a mortgage as far as our debt; we are aggressively paying off my car. We’ve paid a 10% tithe to our church always and we donate extra every month for the needy. We contribute to our 401ks so we aren’t losing money that companies match in benefits. We married before we were in our first professional jobs and we’ve been financially minded the whole time.

My husband is 31 and I’m 29 and we’ve been doing the things I list below since day 1 of my college graduation. Before I had my first teaching job, we also worked a lot of different jobs. Devin was a janitor, I worked in a call center at nights, and I worked doing respite for people with disabilities at one point. Our jobs were very normal and not glamorous. We also lived 10 weeks apart as newlyweds for Devin to do his internship so we had some money coming through while I was student teaching.

I’ve had people ask me several times before how we cut back on money, and when I tell them what we do, they have told me our lifestyle seems depressing. For me, it hasn’t been depressing, sometimes it has been tedious though. We lived without a washer, dryer, dishwasher, and air conditioning to save money our first year of marriage; we caved and finally bought a window unit which was a life saver.

If you feel like changing your financial plans is too late, I promise it isn’t. However, we also knew it would be harder to cut back on what we have if we had become accustomed to a certain lifestyle earlier and couldn’t afford it later. There are a lot of great programs out there to help with debt management etc.

Buying was actually cheaper than rent

When we were deciding where to apply for jobs, we chose somewhere to live specifically for a cheap real estate market. Our first priority had been to live near family, but the companies Devin had applied to for those locations had turned us down. We went back to the drawing board, and we chose markets that had a relatively low cost of living. I’ve had people tell me before that this isn’t an option for them because of A, B, or C, and I get it. However, moving away from family was a sacrifice for us, and we decided to embrace it in a way that was cheap too.

When we moved to the Atlanta metro, we bought within a year of living here because buying (and the upkeep of a home) was actually cheaper than renting. We bought a home with a mortgage that was less than the monthly rent we were already paying, in normal schools, with some projects to do. We never actually looked at what we could pre-qualify for, and we decided we didn’t need anything fancy. We were really open with our real estate agent about our financial goals, and she was extremely respectful in helping us find a home that met those goals.

We live in a 1968 ranch house that immediately needed hardwood floors re-done, a new HVAC, and a gutted backyard. We have the original 1968 kitchen, bathrooms, and everything else (thankfully, we have newish kitchen appliances). I love our home, but even our toilets will be 50 years old this summer! Some quirks about our house: we only have one drawer in our whole kitchen. Our master bathroom has permanently stained tile, and our vanity has been broken since day 1 (we have no working drawers in our master bathroom).

There are many things we could to do update out home, but we’ve prioritized other things like travel. However, I absolutely love this home. I find it incredibly charming and the affordability of it has allowed us to make a lot of other choices for ourselves. Granted, travel will be slowing down the next few years because we would like to fix these things.

We only live on one salary

When I was working full-time as a teacher, we only lived on Devin’s income. Our goal was to set ourselves up for financial security, save a lot in case we had an emergency, and not allow ourselves to have a spendy lifestyle because we knew we wanted me to be a stay at home Mom someday. The only exception to this is we use my blogging cash as fun money for us after we tithe it etc.

Sometimes things were really tight even though we technically had two incomes. I’ll always remember when a coworker told me that I worked full-time so I deserved this or that, but the truth was, I didn’t feel like I deserved something because I worked. I felt like we deserved financial security. We each have an individual budget of money we can spend without talking to the other every month, but it also means that I turn down things often.

When I am not working formally outside of the home, like now, it isn’t a big deal because our expectations don’t outspend our reality.

We budget

We can always do better, but we budget. We use the Mint.com app and categorize our spending that way monthly. We sit down and discuss our financial goals often. We love using the app because when Devin travels it makes our financial discussions very quick because we can see them together. Everything we do fits somewhere into our budget. Like mentioned above, we both get a monthly budget that we can spend without talking to the other (which includes non-date night restaurant eating, clothing, haircuts, etc.). We also have an entertainment budget monthly that includes our dates.

We put family visits on a schedule

We have three sets of parents in three different states. Devin’s brother lives in another state. Devin’s grandparents and the rest of his Mom’s family live in another state. So many states! We live about 9 hours away from our closest family and we typically do most of the visiting. Our first year or two, we made every effort and put all of our time and extra money into visiting family. We realized that our projects piled up at home because we had no extra time and our extra money was spent on gas and plane tickets. We hit a realization that we were wearing ourselves out visiting family, but we needed to invest into our family more.

It was humbling and hard to put family on a visiting schedule for holidays, but it was necessary. We needed some down time for ourselves and we needed some more financial cushion too.

We don’t have a lot of extras

Here are some examples of things we do to save money. I’m sure there are more, but we’ll just keep it simple. On the other hand, I’m sure there are also other areas where we could be more thrifty, and that is why I like brainstorming with friends sometimes.

- I’ve had under 10 manicure/ pedicures in my life.

- All of my makeup is bought from grocery stores.

- Our hair care is cheap. I use economy sized bottles of horse shampoo and conditioner. Devin uses the cheapest shampoo and conditioner he can find. In grad school, I cut my own dang hair, and yes, you read that correctly. I often also cut Devin’s hair. I don’t color my hair, and if I have, it comes from a box.

- My husband is better at bargain grocery shopping than I am, and he actually enjoys it. So, he goes instead of me.

- There have been many times in our marriage when we eat rice and beans, ramen, halved the amount of meat we use in a recipe, or find vegetarian meal options instead of dipping into our savings or second income. In grad school, we celebrated when my husband had some travel clients because it halved our utilities and grocery bill.

- We drive our cars into the ground (or until someone in Atlanta totals them).

- Most of our house is thrifted or hand me downs.

- Almost all of my clothing is thrifted or consigned. The few new things I do buy come from affordable stores like Old Navy or Walmart.

- I chose a grad school program based on being able to receive assistantships which gave me tuition stipends. My assistantship included being paid for teaching a class which helped us build up our savings. We only had to pay for two semesters of tuition for my program.

- We lived without cable for years, but only got it because our internet was cheaper with the deal. That being said, prices have been rising again, and we’re about to get rid of cable completely.

- I go to the library instead of buying books.

- We don’t go to full-priced movies, or if we just have to see something, we go to Matinee showings. Typically, we wait until movies hit Redbox or we go to the $2 theaters.

- We go on cheap dates. The restaurants we go to are usually more affordable rather than aesthetically pleasing or trendy. We tend to only eat out one time a week with a restaurant visit being $25 at most for both of us. Honestly though, we typically go for something cheaper like pizza with a redbox or something similar. In the event we end up eating out more, it comes out of our personal budgets. However, if they had gelato here like we had in Europe, it might be a little harder to resist 😉 .

We keep trying

Some months we do poorly on our budget, and we just have to try again. Other times, we have unexpected expenditures. For example, I was hit in four different car wrecks after we moved here. Often, it took a long time for insurance to pay us back, and it caused some financially hard times for us. Even with the best laid plans, I had someone total my car the week my grad school tuition was due. This single action caused us to have debt for a few months + a monthly car payment that we still have.

However, we keep trying. During financially tight times, we find more ways to cut back.

………………………………….

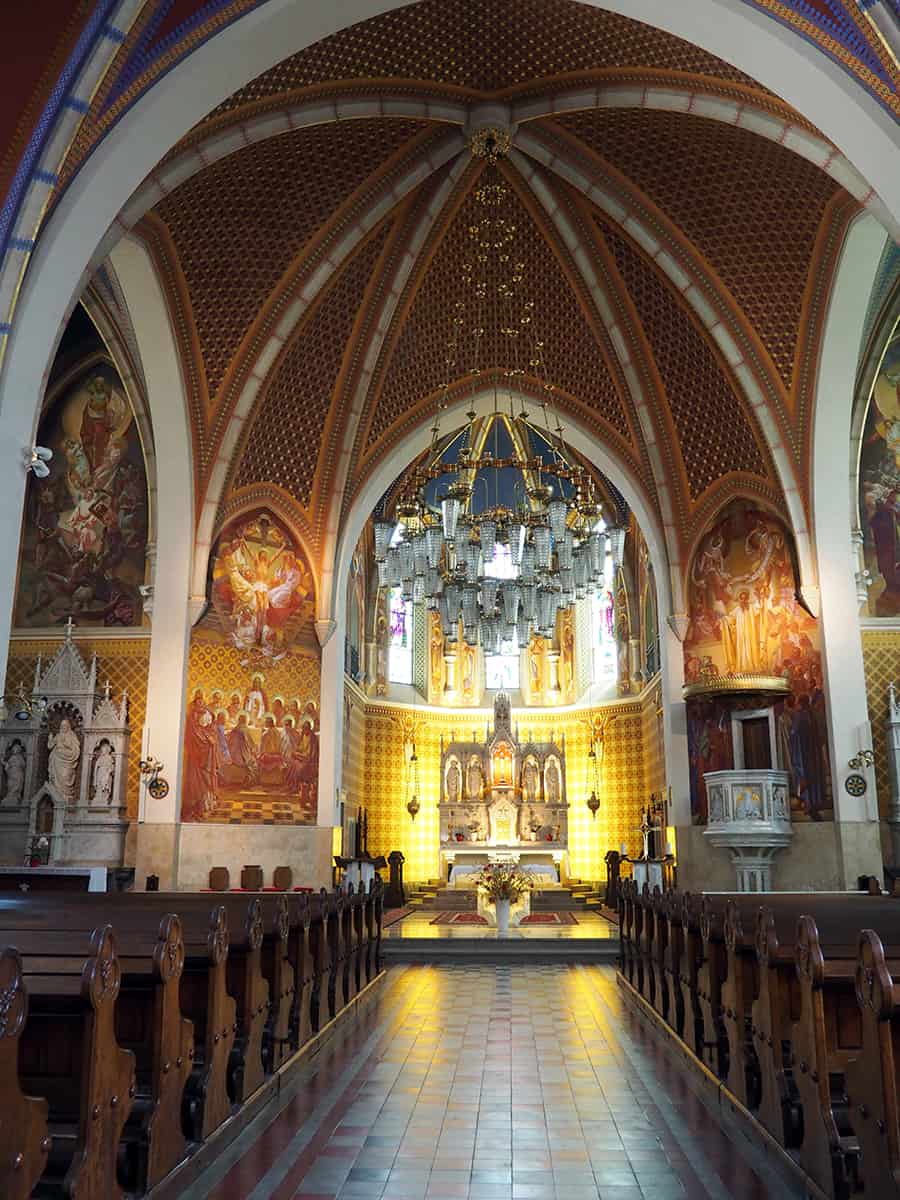

I post pretty travel pictures because what we learn when we travel brings me a lot of joy, but we’re normal people. Our lives are far from perfect. We have weeds in our garden beds right now, and I have a mess of clothes on our bedroom floor. I have a chronic illness, chronic pain, and an anxiety disorder that keeps me on my toes. However, I probably won’t post a picture of those things because I don’t feel like visually documenting those aspects of my life.

When it comes down to it, we don’t have a fancy lifestyle. We are financially independent. We live below our means, and we started making financial sacrifices at the beginning of our careers. We both have simple needs; I credit a lot of that from my living in a small country town and Devin’s family being very practical with their money.